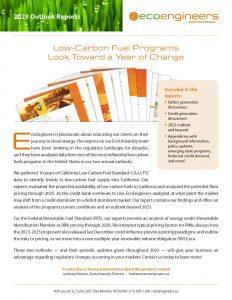

EcoEngineers is passionate about educating our clients on their journey to clean energy. The experts on our EcoUniversity team have been working in the regulatory landscape for decades, and they have analyzed data from two of the most influential low carbon fuels programs in the United States in our two annual outlooks.

EcoEngineers President Brad Pleima, P.E., talks with the chief architects of both reports in the above video. Hear from Dr. Roxby Hartley, Paul Niznik, and Chelsa Anderson on what we can expect during this year of change for both the California Low Carbon Fuel Standard (CA-LCFS) and Federal Renewable Fuel Standard (RFS).

We gathered 10 years of CA-LCFS data to identify trends in low-carbon fuel supply into California. Our experts analyzed potential CA-LCFS credit pricing, including floor pricing, through 2025 and looked at the macro trends to 2030.. As the credit bank continues to rise, EcoEngineers analyzed at what point the market may shift from a credit-dominant to a deficit-dominant market. Our report contains our findings and offers an analysis of the program’s current conditions and an outlook beyond 2023.

For the RFS, our experts provide an analysis of energy credit (Renewable Identification Number or RIN) pricing through 2026. We interpret typical pricing factors for RINs, discuss how the 2023-2025 proposed rules released last December could influence previous pricing paradigms, and outline the risks to pricing, as we move into a new multiple-year renewable volume obligation (RVO) era.

These two outlooks — and their periodic updates given throughout 2023 — will give your business an advantage regarding regulatory changes occurring in your markets. Pricing available upon request.