The following is an article originally published May 3, 2023, by Forbes.

The First Step To Carbon Neutral Is Learning How The System Works

By Shashi Menon, EcoEngineers

Recently, I had the opportunity to spend three wonderful days in Anaheim, California. No, I wasn’t visiting Disneyland; I was attending North American Carbon World (NACW), a conference put on by the Climate Action Reserve.

When the Climate Action Reserve was launched in May 2008 with two projects on its platform, the average price of its carbon offset was $10.20 per ton, which was then quoted as the market’s highest tier of pricing; it hasn’t increased much since then.

Although some carbon sequestration projects claim to receive value in multiples of hundreds of dollars for each ton of carbon sequestered permanently, the average value of a generic forestry project or other greenhouse gas (GHG) reduction mechanism continues to be in the single digits or low double digits. To understand why, we need to dive a little deeper into what shapes carbon markets.

What Are Carbon Markets?

Regulated Markets

There are two types of carbon markets: regulated and voluntary. Regulated markets are managed by governments. According to the World Bank, there are around 70 of these programs globally, and they regulate about 12 gigatons of CO2 (about 23% of global emissions). Major markets created by these programs include the European Emissions Trading Scheme (ETS) and the California Carbon Allowances (CCA).

Regulated ETS or cap-and-trade markets typically establish a cap on emissions and lower the cap each year for industries operating within their jurisdiction.

Unused allowances can be sold, motivating companies to reduce their emissions and sell unused allowances. You can think of these as a license to pollute and the license gets a little more expensive each year thus incentivizing the industry to pollute less.

Voluntary Markets

Voluntary carbon markets are supported by entities such as the earlier-mentioned Climate Action Reserve along with others like South Pole, Terrapass Review and many others. They create “offsets” from verified carbon reduction projects that the private sector can purchase. In other words, instead of lowering emissions from their own operations, hard-to-abate industries can finance emissions reductions in off-site projects.

A look through some protocols can give you an example of these projects: Preserving forests, managing grasslands, low-emissions rice cultivation, livestock methane capture, organic waste diversion, etc.

Current Challenges In Carbon Market Regulations And Pricing Mechanisms

According to the European Energy Exchange’s market data, EU allowances touched $100 per ton in 2022, and California Allowances ended 2022 at around $30 per ton. These prices do not spread to other GHG reduction mechanisms listed on private registries, including the Climate Action Reserve, because most of these projects are not eligible to be used to offset emissions regulated by the ETS programs.

The ineligibility is due to the intent of the regulations, which want the industries in their jurisdictions to emit less from their operations rather than finance a forestry project or fuel switching in another part of the world.

Lack Of Motivation And Innovative Solutions For Industries

So far, the costs of allowances regulated markets haven’t gotten high enough to motivate most industries to invest in costly on-site abatement technologies. In other words, it’s cheaper to continue business as usual than to invest in a radical energy source change for most industries.

I don’t see energy providers offering any innovative, cost-effective, low-carbon solutions that will completely shift business practices in hard-to-abate sectors. The solutions available, such as carbon capture and sequestration, green hydrogen production, full electrification and biofuel use, are struggling to scale under these programs.

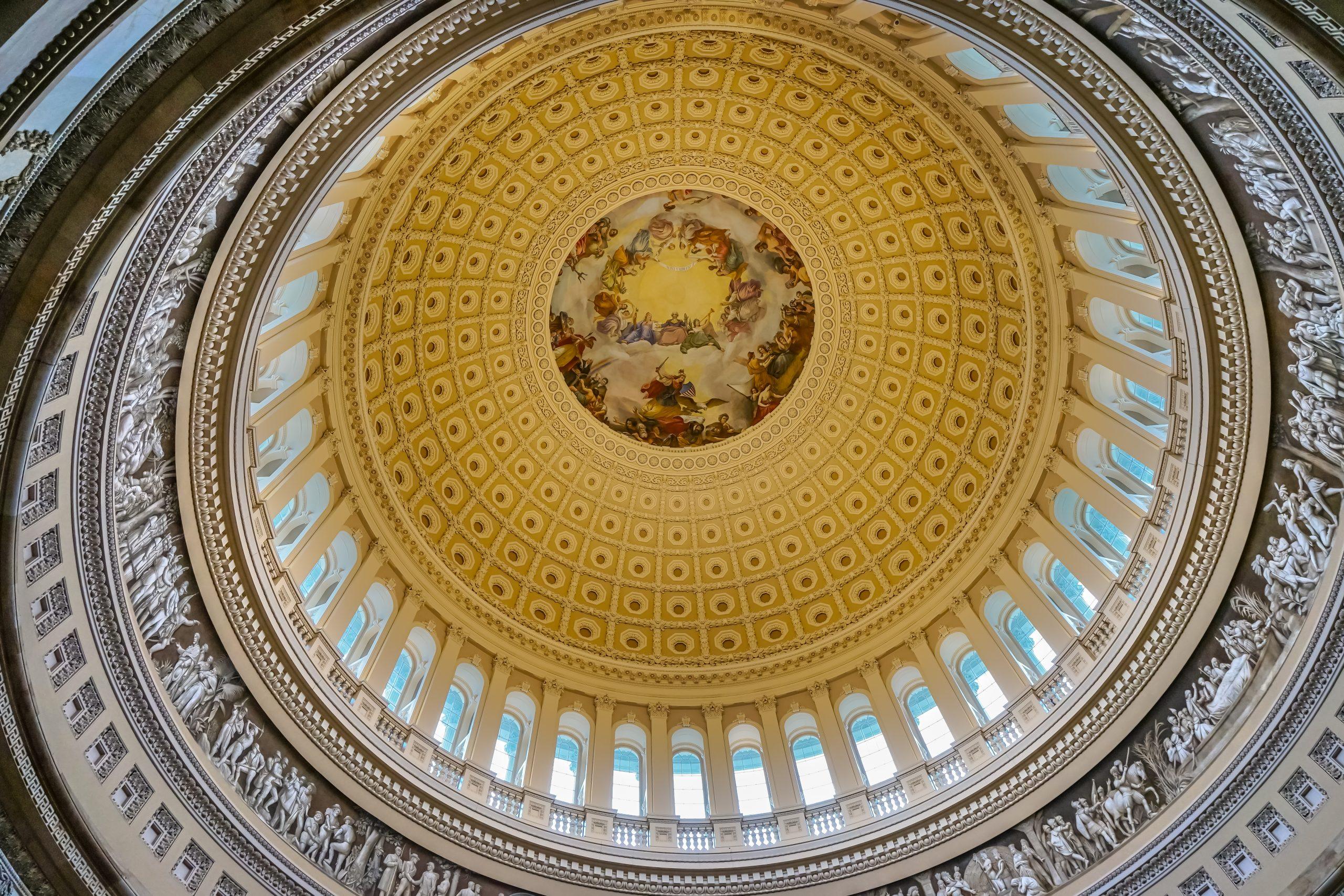

A key objective of landmark U.S. regulations of 2022, such as the Inflation Reduction Act and the Bipartisan Infrastructure Law, is to accelerate private investment in clean energy solutions since the industry has been unable to scale under existing programs.

Carbon Literacy Is Key

I’ve likely touched on new areas for many business leaders—from climate adaptation and mitigation to emissions trading and scope reporting. That’s a lot to learn in one sitting, and it can be overwhelming. Mastery of climate risks and options for an industry sector involves learning many new things including offset purchase strategies, emerging technologies, policy changes, etc.

Assembling all this and analyzing it within the context of different business units usually takes a highly skilled corporate SWAT team with energy transition expertise that can work across different profit centers, which you may not have.

But if you are just beginning your journey, don’t be overwhelmed. I recommend baby steps. You can start by researching the following areas:

- Fundamentals of the carbon cycle.

- Changing realities from a regulatory, customer and shareholder perspective.

- Carbon markets and how they affect your region and sector.

Developing Voluntary Plans For Net-Zero

At the end of the day, I believe anyone operating in today’s business climate needs to understand the potential cost of emissions abatement. While some of this will be driven by mandated programs, the rest will have to be voluntarily developed.

A classic example is California’s plan to achieve net-zero by 2045. In order for this to be successful, I believe state agencies and regulators will need to sit down with industry leaders and develop voluntary plans for their sector, including measurement, reporting and verification methodologies that align with the overarching net-zero goal for the state.

These plans should take a comprehensive look at the cost of technology, compliance costs and the ability to bridge to net-zero through off-site, offset projects that will subsidize clean development in a less developed region in the world.

By starting small and setting learning goals, you can expand your carbon literacy and help be a part of developing these voluntary plans.

Understanding the fundamentals of the carbon cycle, and the changing realities from a regulatory, customer and shareholder perspective, can help demystify and give context to this complicated topic. By starting now in your understanding of the carbon markets, you can be better prepared for the upcoming years.

For more information about the EcoEngineers and the services we offer, contact Shashi at smenon@ecoengineers.us.