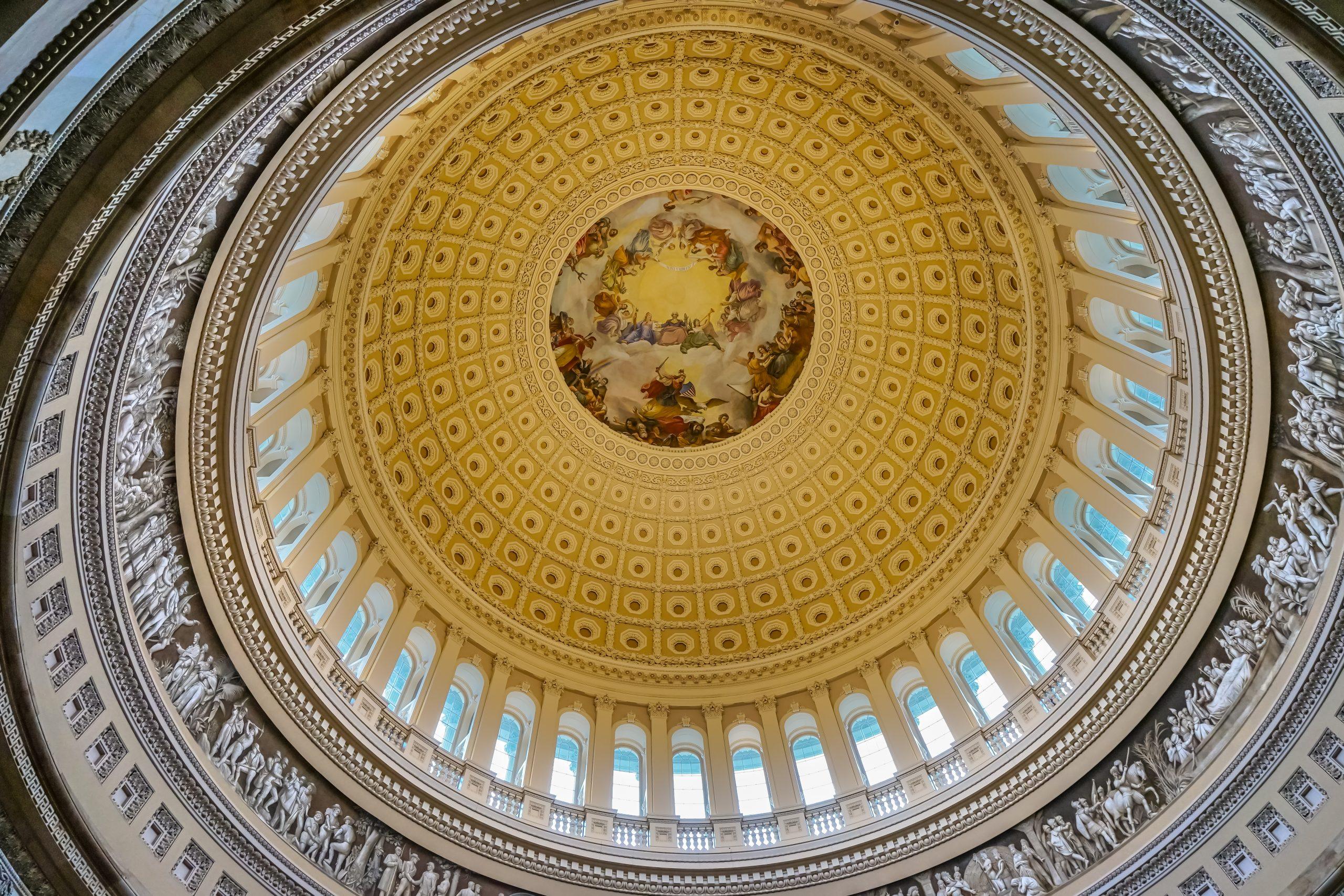

Inflation Reduction Act: Reflecting on One Year of Clean Energy Transformation

We’ve seen significant change since the passage of the Inflation Reduction Act (IRA) just one year ago. Focused on tackling the pressing challenges of climate change and soaring inflation, the IRA has mobilized unprecedented investments in clean energy across various sectors, including renewable fuels, electric vehicles, carbon capture, and energy efficiency initiatives. This article outlines the impact of the IRA, its potential for the future, how you can take advantage of the various incentives, and how EcoEngineers can help you navigate this change.

Driving the Clean Energy Revolution

The IRA was signed into law on August 16, 2022, signaling a new era for energy and environmental investments in the US. Since then, the U.S. Treasury Department has been releasing guidance in response to a barrage of questions from applicants keen to tap into the myriad of opportunities the IRA presents.

The energy-related tax credits in the IRA include:

- 45Q – Provides a tax credit to qualified facilities of $85 per metric ton (/metric ton) of carbon dioxide (CO2) stored or $60/metric ton of CO2 used for enhanced oil recovery or other use. Plants built to capture CO2 from the air can get $180/metric ton. Projects have until January 2033 to begin construction.

- 45Z – Provides a tax credit of up to $1 per gallon (/gal) for domestic production of clean transportation fuels between Dec. 31, 2024, and Dec. 31, 2027. Ethanol plants claiming credits under 45Z don’t have to sequester CO2; they can use it for other purposes.

- 45V – Provides up to $3 per kilogram (/kg) of hydrogen produced with reduced greenhouse gas (GHG) emissions. The tax credits may be claimed for 10 years on hydrogen sold or used. Hydrogen is an ingredient in fertilizer and has other industrial uses.

- 40B – Provides a credit of $1.25/gal of sustainable aviation fuel (SAF) in a qualified fuel mixture. SAF must have a baseline lifecycle GHG emissions reduction percentage of 50% compared to petroleum jet fuel. The regulation further incentivizes carbon intensity (CI) reduction by including an additional $0.01/gal tax credit for each percentage point above the 50% reduction for a maximum of $1.75/gal. (Note: The tax credit will not apply to fuel derived from co-processing with non-biomass feedstocks, palm fatty acid distillates, or petroleum.)

- 48C – Provides $10 billion in credit for qualifying advanced energy products – $4 billion of which must go to projects in designated energy communities. To qualify for the credit, a project must re-equip an industrial or manufacturing facility for the production or recycling of numerous energy types, among other criteria. The first round of funding opens May 31, 2023, and initial concept papers are due July 31, 2023.

- 48X – Provides tax credits for the production and sale of components related to solar PV modules, battery and energy storage components, and critical mineral sourcing and processing. The 45X credit will begin to phase out in 2030 and be completely phased out after 2033. Manufacturers cannot claim 45X credits for any facility that has claimed a 48C credit.

A Decade-Long Commitment with Lifelong Benefits

While the IRA extends and modifies various energy-related provisions and incentives for 10 years, the law’s true power lies in its ability to plant seeds of a low-carbon future that will grow for the next 30 to 40 years. By spurring investments in clean and renewable energies, the IRA is set to dramatically change how we produce and consume energy, reducing emissions from carbon-intensive and hard-to-abate processes such as cement, steel, and fertilizer production, to name a few.

Direct Pay and Transferability

Under the IRA, certain taxpayers may elect for a direct payment in lieu of a tax credit or make an election to transfer all or a portion of an eligible credit to an unrelated taxpayer. This allows non-profits, state and local or tribal governments, and rural cooperatives that don’t have an income tax to be eligible to claim clean energy tax credits. For-profit entities like smaller developers who don’t have a large income tax obligation can transfer or sell the tax credits to an unrelated entity. This rule solves the inefficiencies of traditional tax equity financing and is anticipated to bring more liquidity to clean energy projects.

Decarbonization Potential Unleashed

By incentivizing clean energy initiatives across a host of industries, the passage of the IRA, in combination with the Bipartisan Infrastructure Law signed into law in November 2021, could achieve a 35%-41% reduction in economy-wide GHG emissions below 2005 levels by 2030 over its lifetime, according to the U.S. Department of Energy (DOE). The Biden administration estimates that the clean energy provisions of the IRA and the Bipartisan Infrastructure Law together could reduce emissions by more than 1 billion tons of CO2e in 2030, equivalent to the combined annual emissions released from every home in the United States.

Taking Advantage of the Incentives

The tax code can be a challenge to read. Below are just a few resources to help you unravel the IRA:

- Visit IRAtracker.org and look at it through the lens of your existing business and GHG reduction goals. The tracker, which is linked to the IRA database, lays out details about the types of projects eligible for incentives to help you determine whether the opportunities meet your needs.

- Check out the “Understanding the IRA hub” developed by the Environmental Defense Fund (EDF) in partnership with Deloitte to see if any of the use cases fit your company’s needs.

- Visit Invest.gov, which lists businesses making investments supported by the IRA, Bipartisan Infrastructure Law, and CHIPS and Science Act.

About EcoEngineers

EcoEngineers is a consulting, auditing, and advisory firm with an exclusive focus on the energy transition. From innovation to impact, Eco helps its clients navigate the disruption caused by carbon emissions and climate change. Eco helps organizations stay informed, measure emissions, make investment decisions, maintain compliance, and manage data through the lens of carbon accounting. Its team of engineers, scientists, auditors, consultants, and researchers live and work at the intersection of low-carbon fuel policy, innovative technologies, and the carbon marketplace. Eco was established in 2009 to steer low-carbon fuel producers through the complexities of emerging energy regulations in the United States. Today, Eco’s global team is shaping the response to climate change by advising businesses across the energy transition.

For more information about EcoEngineers’ role in helping interested parties participate in the IRA, contact us at clientservices@ecoengineers.us.